search news

Report - Real Estate Market - May

01 June 2018

Real estate market

After the initial boost from Golden Visa Program, attracting many investors from outside the Schengen zone, tourism has been the major driver of growth and changes in the market in Lisbon. The refurbishing of buildings for residential use for high networth clients and conversion into hotels has tried to respond to the explosion of Short Term Rental. This movement, initially highly concentrated in the historic zone, has ended up by spreading in waves to other areas of the city, putting pressure on sale and rental prices. Related to the latter, there have been protests which, although isolated, were heeded by the government and parties that support it, leading to:

1) Proposals to limit non renewal of rental contracts in force

2) Initiatives to introduce quotas or other types of barriers to Short Term Rental

3) Increased benefits granted to beneficiaries under the Affordable Rent Program (created in 2016 but until now has had little impact)

The representatives of the Owners, Promoters and Companies of Construction viewed all these measures with concern and advised the public authorities to be more active concerning the availability of buildings through more efficient use of buildings which the City Hall or State own or run. The APPII also takes a critical position over the Government’s strategy, considering that it will have a negative impact and that measures like "lifelong" rentals and a return to a “freeze" on rents "are very dangerous", and are already "scaring many investors".

According to the PHMS (Portuguese Housing Market Survey) questionnaire, one may conclude that there continues to be reduced availability of properties for sale and rental.

Bank evaluations and the value of mortgages continue to rise.

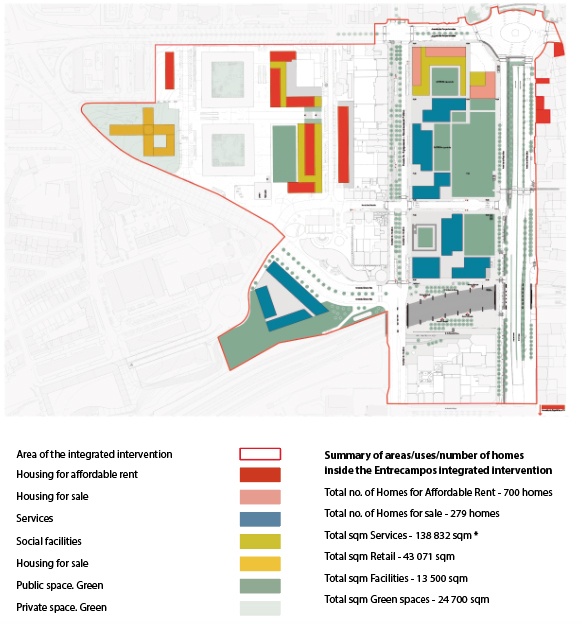

Lisbon City Hall announces the “Entrecampos Integrated Intervention” in collaboration with the Social Security for the former Popular Fair Grounds

This project, the main asset of which is the site of the former Feira Popular that has been abandoned for so many years, includes the requalification of the northern part of the Avenida da República and Avenida 5 Outubro, and also covers an area of municipal land next to the Avenida das Forças Armadas and between Avenida Álvaro Pais and the railway line near Entrecampos station. The projects plans a total of €800 M of investment of which around €100 M is public money and will include office buildings and around 979 homes and residences of which 700 will be for affordable rent and the others for sale. The initial stage of the project contemplates the conversion, by 2019, of 5 buildings in the Avenida da República. These are in use by the Social Security and will be restored and converted for housing use.

Foreign investors - Change of paradigm - From the End Investor to the developer

While the Residence Permit for Investment Activity Program (ARI) / Gold Visas stagnates, new promotion investments are being announced, and not only in the residential market. There was a drop in the demand for "Golden Visas"/ ARI in April, returning to the average values of 2017 (€100 M/ month). Additionaly these values may be due to the late issue of visas. In spite of this, 606 Visas and €573 M were granted up to April, meaning there is a possibility of heading towards a new annual record.

New Property on the Market and Relevant Transactions

• Vanguard announces a new residential investment in Tomás Ribeiro - a restoration project worth €18M

• CTT sold a building in Rua da Palma, near Martim Moniz, for 10.3 million Euros

• Group Avenue entered the services buildings market with the EXEO Office Campus project, in the Parque das Nações, in Lisbon. The space of 69,000 m2 went for €150 M.

• BMP REP bought a building in the Av. Liberdade for a price above 7,000/m2 (€18M total).

• Given the scarcity of offer in the CBD, office buildings may begin to be transacted at prices closer to the values per sqm of the Residential segment, without which they will be "ousted" from this zone.

Ranking of Portuguese Universities continues to attract students and put pressure on prices

Católica Lisbon School of Business and Economics, Nova School of Business and Economics and Porto Business School and also now the ISCTE Business School are in the top 100 best schools in the world for the training of executives, in the Financial Times ranking. Combining the reputation of its schools, the cost of living and pleasant climate, Portugal is now increasingly on the map for international students. This trend, although for the niche segment of “student housing”, represents an opportunity for the real estate market in Lisbon.

Parliament has approved the Draft Law that requires banks to fully reflect the decrease in the Euribor in housing loan contracts

The interest rate applied by banks in the home loans, will have to reflect the evolution of the reference rate, even when this is negative. The banks can, however, opt to do so through a credit to be applied when interest becomes positive again.

Artigo 21.º-A

Taxa de juro de valor negativo

1 - When the calculation of the interest rate results in a negative value this is to be reflected in the loan contracts contemplated in article 2.1.a).

2 - For the purposes of the provisions in the previous point, the negative value arrived at should be deducted from the outstanding capital in the instalment falling due.

3 - Without prejudice to the provisions in the previous point, the creditor can opt to set up a credit in favour of the client of an amount identical to the negative values calculated pursuant to no. 1, to be deducted from the interest falling due, from the time when these become positive, with the interest falling due being deducted from the credit, until this is used up.

4 - If at the end of the period agreed for the credit agreement there are still credits in the client’s favour, the banks should pay this back in full.

Housing framework law in public consultation up to 13 July

On 26 April the Council of Ministers approved the legislative package of the New Generation of Housing Policies.

The intention is that from a housing policy whose main instruments were based on the construction of new accommodation and on support for the purchase of housing to a policy that favours restoration and rental.

The investment policy of the FNRE (National Fund for Building Rehabilitation) is oriented by the allocation of the majority of the restored area, in overall terms, to the rental market for housing in conditions that are affordable to the middle class, including temporary residences for students.

Main quantitative goals to attain in the mid-term:

a) To increase the percentage of housing with public support, in housing as a whole, from 2 % to 5 %, which represents an increase of around 170 000 homes;

b) To lower the surcharge rate of expenditure on housing in rental regime from 35 % to 27 %.

c) To make restoration the main form of intervention for buildings and urban development

New Residential Rents Law

Last Wednesday the Assembly of the Republic approved the draft law of the Socialist Party (PS) that suspends eviction proceedings of elderly or disabled people, including those that are already in progress, until the alterations to the rental law are approved, which are to be discussed in Parliament.

The goal will be to base the housing policy on two new foundations: urban renewal and rental, instead of the classic “new construction” and “support for house purchase”.

The proposal from the Socialists, approved on 24 April in the Housing, Urban Renewal and Urban Policies working group, is to create an “extraordinary and transitory regime of protection for elderly and disabled people who are tenants and live in the same place for over 15 years“.

This law covers all rental contracts for housing whose tenant has lived for more than 15 years in the house on the date the law comes into force, who are 65 years old or older or have a disability of over 60%. In these cases, landlords are prevented from evicting tenants until the revision of the urban rental regime comes into force, which will be discussed in Parliament, at least, by June. The law even covers eviction proceedings already in progress.

SIIMGROUP NEWS

SIPP - Portuguese Real Estate Show in Paris

Siimgroup was at the SIPP (Portuguese Real Estate Show in Paris), last 18, 19 and 20 May. 170 exhibitors were present, the large majority of wich real estate brokerage firms, unlike previous editions, where law firms and tax advisors and accounting companies were in the majority.

There were an estimated 20,000 visitors, but the estimates of the AIP and of the APEMIP indicate that this number may have been greatly exceeded.

The profile of visitors also changed compared to previous editions, the overwhelming majority of whom were looking for suitable strategic partnerships for buying properties in Portugal. Most of the visitors were already familiar with the National Programs of Tax Incentives for Non-Habitual Residents and for Investment. Everyone agrees that for the French investor, Portugal has unique characteristics and particularities.

The event was officially opened by the Secretary of State for Tourism, Ana Mendes Godinho, accompanied by the Portuguese Ambassador in France, Jorge Torres Pereira, Luís Lima, Chairman of APEMIP, the Portuguese Consul in Paris, Director of the AICEP in Paris, and the Director of the Portuguese Tourist Board in Paris, among others. Diverse Mayors of Portuguese Municipalities were also present.

During the last week the Real Estate Show was advertised in many Metro stations and on all the buses in Paris. A lot of the press and even television programs have been talking about French moving to Portugal.

RE/MAX Collection Siimgroup in the 98th CSIO Lisbon 2018

For the fourth consecutive year, Siimgroup will be present with a stand in the Official International Show Jumping Competition of Lisbon (CSIO), which will be held in the Hippodrome of Campo Grande, in the Portuguese Equestrian Society between 31 May and 3 June. The city will receive the best national and international horse riders for a memorable event.

The Official International Show Jumping Competition of Lisbon continues to be a benchmark event not only on the international equestrian calendar, and the CSIO is the oldest event of its kind in the world held in the same place.

Around 75 riders will take part in the event, representing more than 15 countries, with 200 horses. This is a high-level sports event, of national and international interest, attracting a big national and international crowd.